Geography is Dead: Why Minnesota’s Online Wine Retailers Act Like They’re in Poland

For decades, the wine and spirits industry has been obsessed with terroir, the idea that location is the primary determinant of character. We’ve applied this same logic to retail business, assuming that a merchant in Napa Valley operates in a completely different economic reality than one in Lisboa or Tokyo.

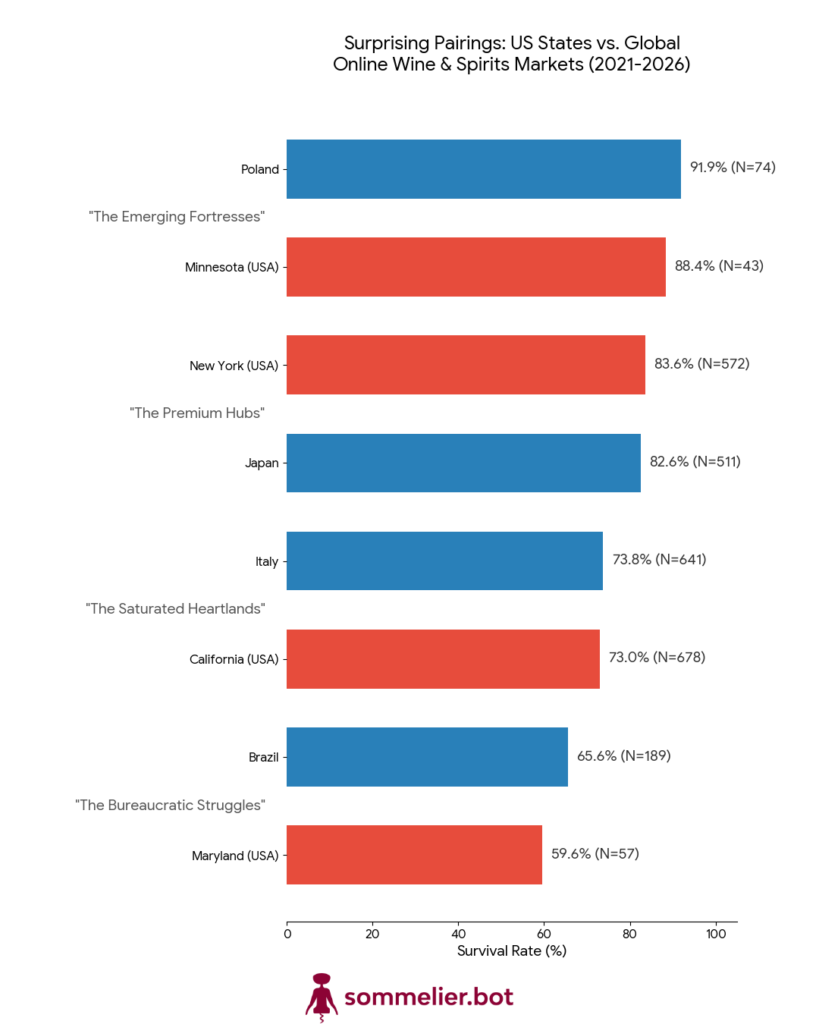

Our latest analysis at sommelier.bot, tracking the survival of over 13,500 online retailers through the crash of 2021-2026, proves that in the digital age, market structure matters far more than physical location.

By taking a data-driven approach and matching US states (with sample sizes N>30) against global countries that share near-identical survival rates, we have identified four distinct global “Retail Archetypes.” These pairings reveal that the forces dictating success or failure—saturation, regulation, and density—transcend borders.

Geography is no longer destiny; structure is.

1. The Emerging Fortresses (Minnesota & Poland | ~90% Survival)

Who knew that Minnesota was one of the safest places on Earth to sell wine and spirits online? With survival rates hovering around 90%, it performs in lockstep with Poland, one of Europe’s most resilient markets.

- The Shared Structure: Both are often characterized as “flyover” or secondary markets by major global players. This perception is their greatest strength. They have established consumer demand and growing economies, but they have not yet been saturated by the hyper-aggressive, venture-backed competition found in primary hubs.

- Why They Win: Established local players face less predatory competition. They have breathing room to build loyal, localized customer bases that aren’t constantly being poached by unsustainable discount models. In these markets, being a solid, reliable local merchant is still a viable path to long-term longevity. They are fortresses built on stability, not hype.

2. The Premium Hubs (New York & Japan | ~83% Survival)

Despite being on opposite sides of the globe and culturally distinct, New York City and Japan share virtually the same retail DNA, reflected in their impressive ~83% survival rates.

- The Shared Structure: Both are defined by extreme population density, immense wealth, and a highly sophisticated consumer base. Rents (physical and digital) are astronomical, and client expectations are sky-high.

- Why They Win: In these environments, you cannot survive by being a generic warehouse. The cost of doing business is too high for low-margin commodity sales. Online retailers here don’t just sell “booze”; they sell curation, access, and expertise. The data proves that in wealthy, dense urban centers, the demand for specialized, high-touch, premium retail is incredibly resilient, even during an economic downturn. Survival here requires being best-in-class.

3. The Saturated Heartlands (California & Italy | ~73% Survival)

You would expect the world’s most famous wine production regions to be the easiest places to succeed as a retailer. The data says otherwise. California and Italy, the spiritual homes of wine, are barely “average” performers in the digital space.

- The Shared Structure: Being a famous wine hub is a double-edged sword. The cultural dominance of wine means the barrier to entry feels low. Everyone wants to open a wine shop in Tuscany or Napa. This leads to massive, chronic oversaturation.

- The Trap: With so many shops fighting for the same eyeballs, product differentiation approaches zero, and fierce price wars become inevitable. The high “churn rate” in these regions (over 1 in 4 failing) reflects a brutal environment where only the most efficiently run or uniquely positioned businesses can survive when the margin is squeezed. Proximity to the product does not guarantee profits.

4. The Bureaucratic Struggles (Maryland & Brazil | ~60% Survival)

At the bottom of the pack, we find an unlikely pairing between a US state and a South American giant, both struggling with survival rates near 60%.

- The Shared Structure: The common enemy here is not market competition, but the state itself. Brazil is infamous for its “Custo Brasil”, the intense complexity of its tax and regulatory framework. Similarly, Maryland operates under some of the most restrictive and complex alcohol control laws in the US, a legacy of the three-tier system that imposes immense friction on digital commerce.

- The Killer: The data shows that extreme regulatory friction is just as deadly to a business as a massive recession. Red tape acts as a constant tax on time, resources, and agility, making it incredibly difficult for small, independent online retailers to achieve sustainable margins.

The Verdict: Look at the Mechanics, Not the Map

For any retailer planning their strategy for 2027 and beyond, this analysis provides a crucial framework. Don’t just look at a map; look at the mechanics of your market.

If you are in a Saturated Heartland, you need to differentiate radically or die by the sword of price competition. If you are in an Emerging Fortress, double down on local loyalty before the giants arrive. And if you are in a Premium Hub, invest in the highest possible level of service and curation.

Most importantly, if you are an independent retailer tired of fighting these structural battles alone, it’s time to consider a new model. The cooperative model, empowered by AI, offers a way to build collective structural strength regardless of your geography.

Join the Federation

On your own you go fast, together you go further. If you’re an online wine & spirits merchant ready to stop renting your future, we want to hear from you.

→ Contact us at sommelier.bot to discover how our Cooperative AI Platform can help you scale your expertise, federate your inventory, and deliver a true sommelier experience, without sacrificing your identity to the aggregators.

The merchants who thrive in 2030 won’t be the ones who fought alone, they’ll be the ones who federated together.

#WineRetail #FederatedCommerce #WineIndustry #DigitalSommelier #RetailResilience #WineTech #IndependentRetailers