The Asia Paradox: How Japan’s Online Retailers Survived the Crash (And Why China’s Didn’t)

Asia is often treated as a monolithic emerging block in global retail reports, a vast territory of unbridled digital growth. But our latest longitudinal study at sommelier.bot proves this narrative is dangerously simplistic.

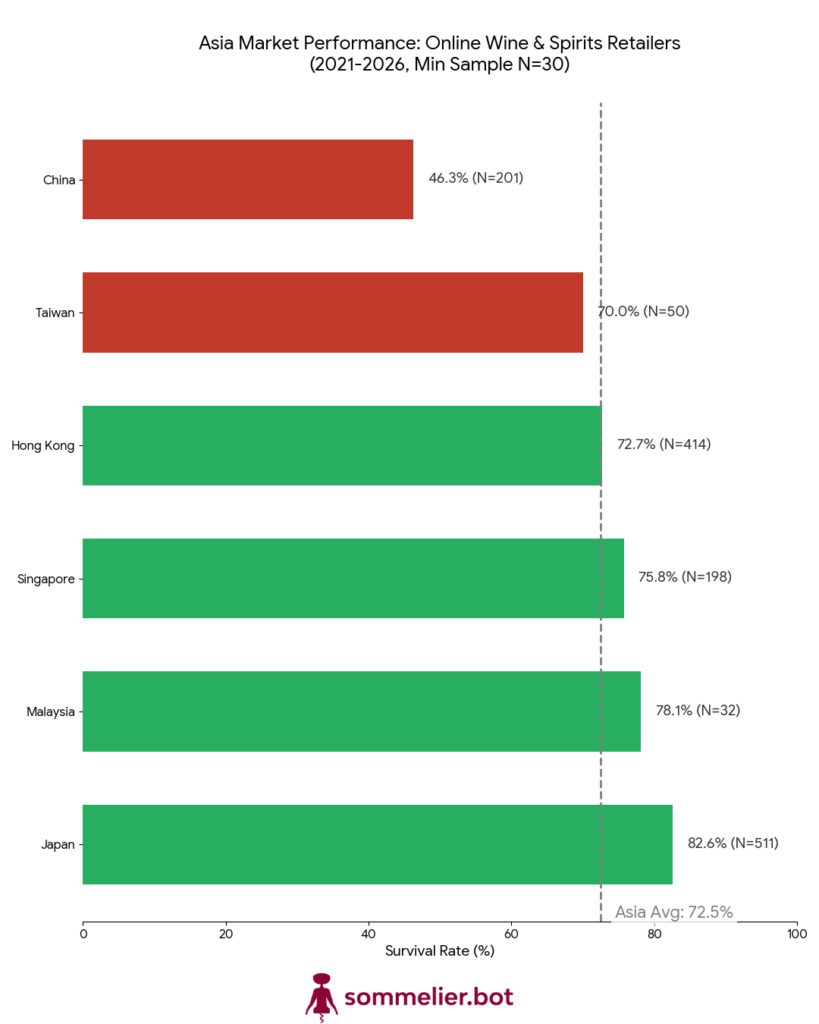

Tracking over 13,500 online wine and spirits retailers globally from the pandemic boom of 2021 to late 2025, we found that while Asia averaged a respectable 72% survival rate, this figure masks a profound digital divide. The region is not a single story; it is a tale of two distinct business philosophies yielding wildly different results in a high-stress economic environment.

The data reveals a stark contrast between the Service Fortresses of mature markets like Japan and the Platform Tenants of hyper-centralized markets like China. Understanding this divergence is key for any business building a strategy for the next decade of digital commerce.

The China Crash: The High Price of Rented Land (46.3% Survival)

China’s survival rate of 46.3% is the lowest among major economic powers in our entire dataset. This statistic is a brutal wake-up call for the growth-at-all-costs model of e-commerce.

This collapse is the textbook definition of the Platform Trap. In China, the digital ecosystem is almost entirely enclosed by super-apps and centralized marketplaces like WeChat, Tmall, and JD.com. For a wine or spirits retailer in 2021, getting online didn’t mean building a website and an email list; it meant opening a storefront within one of these walled gardens.

The initial traffic was intoxicating, but the long-term economics were toxic:

- Loss of Leverage: Retailers were forced to pay increasingly high rents for visibility, participating in pay-to-play algorithm games that crushed margins.

- Data Deprivation: Crucially, these retailers did not own the customer relationship. The platform owned the data. The retailer was merely a fulfillment node.

- Commoditization: On a centralized platform, differentiation dies. You are not a boutique merchant with a unique perspective; you are a product listing next to an identical product listing, competing solely on price.

When consumer spending cooled and capital tightened between 2024 and 2026, these tenant businesses had no independent foundation. They had bought traffic, but they hadn’t built loyalty. When the traffic got too expensive to buy, the business model simply evaporated.

The Japan Fortress: Resiliance Through Omotenashi (82.6% Survival)

On the other side of the spectrum is Japan. With an exceptional 82.6% survival rate, it outperformed not just the rest of Asia, but most of the Western world, including the US.

Japan’s success is built on a fundamentally different retail DNA. It is a market characterized by fragmentation, stability, and a deep cultural emphasis on quality and service. Japanese online wine and spirits retailers tend to double down on the concept of Omotenashi, a philosophy of wholehearted, high-touch hospitality that anticipates a customer’s needs.

Instead of trying to out-scale the competition with massive, impersonal catalogs, Japanese merchants focused on deep specialization and curated experiences. They used digital tools not to replace the human element, but to enhance it.

- Direct Relationships: They invested in building their own digital storefronts and direct communication channels, ensuring they owned the customer data and the relationship.

- Trust as a Moat: In a market flooded with options, they became trusted advisors. They survived because they offered something an algorithm couldn’t: genuine curation and trust.

This high-service, high-trust model insulated them from the race-to-the-bottom pricing wars that decimated their counterparts in more commoditized markets. Their customers weren’t loyal to a platform’s discount code; they were loyal to the merchant’s expertise.

The Strategic Takeaway for the Next Decade

The divergence between Japan and China is a clear signal for the future of online retail globally. The era of easy growth through platform dependence is over. The 2026 data proves that centralization kills resilience.

For retailers moving forward, the only sustainable path is to break free from total aggregator dependency. You must build direct, data-owned relationships with your customers. This doesn’t mean rejecting technology; it means using it strategically to empower your unique value proposition, not to outsource it.

This is precisely why sommelier.bot is focused on “Federated AI.” We believe the future lies in giving independent retailers the tools to offer the high-touch, personalized service of the Japanese model at the scale demanded by the modern digital economy—without handing the keys to your business over to a tech giant.

Join the Federation

On your own you go fast, together you go further. If you’re an online wine & spirits merchant ready to stop renting your future, we want to hear from you.

→ Contact us at sommelier.bot to discover how our Cooperative AI Platform can help you scale your expertise, federate your inventory, and deliver a true sommelier experience, without sacrificing your identity to the aggregators.

The merchants who thrive in 2030 won’t be the ones who fought alone, they’ll be the ones who federated together.

#WineRetail #FederatedCommerce #WineIndustry #DigitalSommelier #RetailResilience #WineTech #IndependentRetailers